Iga List Irs

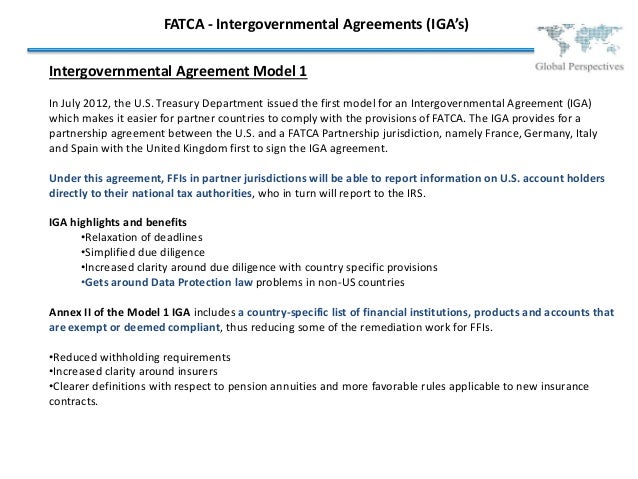

Treasury lists the countries and territories that have signed FATCA IGAs or where they are pending but it is no surprise that they do not go out of their way to tell you about the countries without such agreements. Under the rules of a Model 2 IGA.

View all Featured Stories.

Iga list irs. The IRS will publish a list identifying all Partner Jurisdictions. What is an IGA. This list also includes jurisdictions that have reached agreements in substance with the United States on the terms of the IGA and have consented to be included on the website even though those.

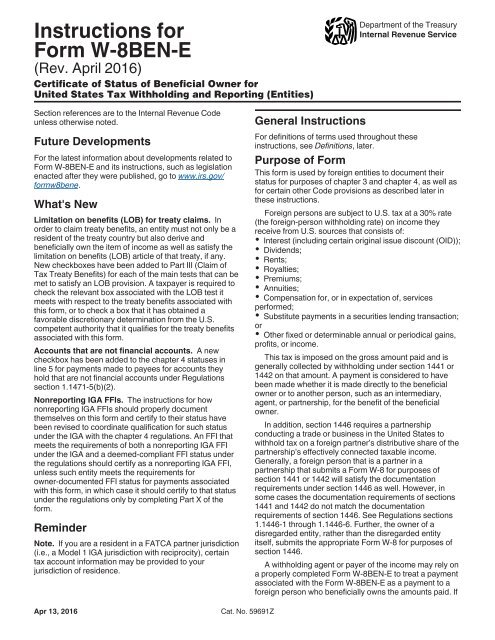

Office of Inspector General OIG Treasury Inspector General for Tax Administration TIGTA Special Inspector General for the Troubled Asset Relief Program SIGTARP Special Inspector General for Pandemic Recovery SIGPR. IGA is simply shorthand for intergovernmental agreement. See the FFI List Search and Download Tool User Guide PDF for instructions to use the tool.

This is the only list that will be published before withholding begins. 1 in the case of the United States the Secretary of the Treasury or his delegate. Important definitions with regard to Foreign Account Tax.

How do I access it. Under a Model 1. E The term Partner Jurisdiction means a jurisdiction that has in effect an agreement with the United States to facilitate the implementation of FATCA.

Model 1 agreements and model 2 agreements. C The term IRS means the US. Treasury Announces Seven Additional Policies to Encourage State and Local Governments to Expedite Emergency Rental.

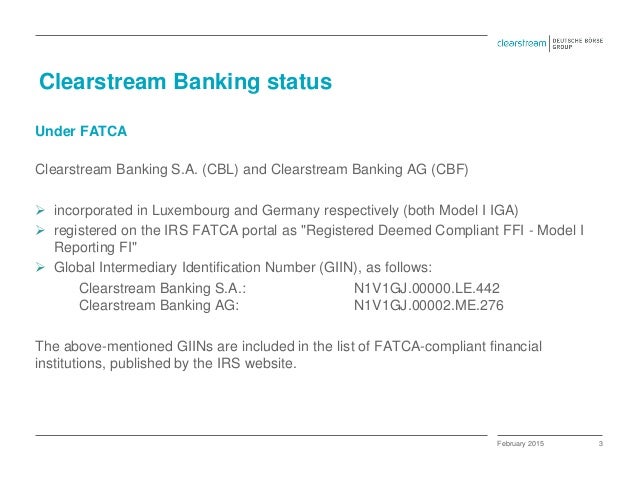

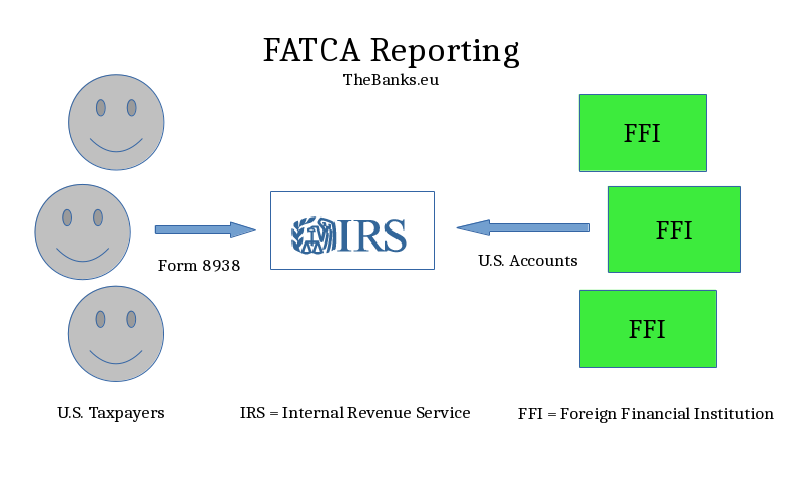

The list of FFIs that have completed registration and obtained a global intermediary identification number GIIN is available using the FFI List. The IRS shall publish a list identifying all Partner Jurisdictions. 6 The IRS has a list of countries with which it has executed intergovernmental agreements IGAs to authorize the implementation of FATCA in that jurisdiction.

IGA is not in fact signed and therefore treated as being in effect by July 1. Algeria 6-30-2014 Angola 11-30-2014 Anguilla 6-30-2014. Austria 4-29-2014 Bermuda 12-19-2013 Chile 3-5-2014 Hong Kong 11-13-2014 Japan 6-11-2013 Moldova 11-26-2014 Switzerland 2-14-2013 FATCA IGAs under discussion.

F The term Competent Authority means. Internal Revenue Service IRS Office of the Comptroller of the Currency OCC US. In non-IGA countries some banks have registered and received a GIIN and you can find these on the IRS website but they also dont go out of their way to list banks.

What is the IRS FFI List. Prior to this notice FFIs were required to register by April 25 2014 to ensure that they would be included on the first IRS FFI list. 7 See 4 for the definition of Financial Institution.

Most of the countries which signed the IGA are under Model 1 with some are nonreciprocal eg. The list of IGAs can be found at httpswwwtreasurygovresource-centertax-policytreatiesPagesFATCA. And 2 in the case of the Cayman Islands the Tax Information Authority or its delegate.

To implement FATCA the United States government has developed two forms of IGAs. Other FFIs that expect to be reporting Model 1 FFIs wish to ensure their inclusion on the first IRS FFI List in order to simplify the documentation of their status with withholding agents even though withholding agents should not require reporting Model 1 FFIs to provide GIINs until January 1 2015 but are. Todays announcement provides the assurance that FFIs will be included on this list if they submit a complete registration form by May 5 2014 instead of April 25 as originally announced.

FFIs located in a Model 2 IGA jurisdiction Reporting Model 2 FFIs must register with the IRS and agree to comply with the terms of an FFI agreement. Failure to provide this information to the local taxing authority or to the IRS can result in a 30 percent withholding penalty being assessed against the banks US. Treasury Department Treasury and Internal Revenue Service IRS issue regular updates announcing jurisdictions that have an IGA in effect through a listing on the Treasury and IRS website.

The FFI List is issued by the IRS and includes all financial institutions branches direct reporting non-financial foreign entities sponsored entities and sponsored subsidiary branches that have submitted a registration and have been assigned a Global Intermediary Identification Number GIIN at the time the list was compiled. D The term FATCA Partner means. Office of Inspector General OIG Treasury Inspector General for Tax Administration TIGTA Special Inspector General for the Troubled Asset Relief Program SIGTARP Special Inspector General for Pandemic Recovery SIGPR.

The list is compiled on a monthly basis and published the first day of. Model 1 iga country list keyword after analyzing the system lists the list of keywords related and the list of websites with related content in addition you can see. However below is the list of the countries are signed under Model 2 which means the local FFIs are required to report information directly to the IRS.

GIIN is an abbreviation of Global Intermediary Identification Number. Get Global Intermediary Identification Number GIIN composition information for the IRS Foreign Account Tax Compliance Act FATCA Registration System. Internal Revenue Service IRS Office of the Comptroller of the Currency OCC US.

Countries with FATCA agreements under discussion but considered compliant are. Use the FFI List Search and Download Tool now. Model 2 IGA.

It can download the entire list of Financial Institutions or search for a particular one by its legal name Global Intermediary Identification Number GIIN or country. Under the Foreign Account Tax Compliance Act FATCA withholding agents must withhold tax on certain payments to foreign financial institutions FFIs that do not agree to report certain information to the IRS about their US. Armenia agreement in substance Austria.

Treasury and IRS Announce Families of Nearly 60 Million Children Receive 15 Billion in First Payments of Expanded and Newly Advanceable Child Tax Credit. PDF 檔案Reporting Model 2 Foreign FI US IGA This is a Reporting FI in a jurisdiction that has entered into a Model 2 IGA. An organization that is not considered a financial institution is considered a non.

Understanding the Child Tax Credit. Accounts or accounts of certain foreign entities with substantial US.

Global Fund Regulation Update Summer 2014

Which Nations Have Igas With The United States

From Principles To Planning Fatca What You Need To Know From Principles To Planning Ppt Download

Https Www Unibank Com Pa Sites Default Files Attachment Fatca Ingles Pdf

Irs Unveils Fatca Model 2 Iga Reporting Deadline Extensions For Financial Institutions

Kwm Fatca Related Iga Between Prc And Us Has Been Reached In Substance

Https Www Irs Gov Pub Irs Drop Uzbekistan Competent Authority Arrangement Pdf

Https Www Pwc Com Jm En Fatca Pdf Globalirwnewsbrief Treasuryreleasessecondmodelagreementforimplementingfatca Pdf

Https Www Irs Gov Pub Irs Drop Rp 17 16 Pdf

Https Group Bnpparibas Uploads File Fatca 2018 07 23 En Pdf

Fatca Iga Countries Deloitte Ireland Financial Services Tax

Https Www Irs Gov Pub Irs Drop Uzbekistan Competent Authority Arrangement Pdf

Fatca Iga Countries Deloitte Ireland Financial Services Tax

Https Www2 Deloitte Com Content Dam Deloitte Lu Documents Tax Operationaltaxnews Lu Otn Fatca Update October 2016 11102016 Pdf

Instructions For Form W 8ben E

Which Nations Have Igas With The United States

Https Www Bzst De Shareddocs Downloads De Fatca Notice 2017 46 Pdf Blob Publicationfile V 2

0 Response to "Iga List Irs"

Posting Komentar